Ever noticed 1000pepe’s price suddenly spike or crash for no apparent reason? Chances are, you’re witnessing 1000pepe whales in action. These large holders can move markets with a single transaction, and understanding their behavior is crucial for any serious investor. But whales don’t operate in a vacuum—they swim in the ocean of a project’s 1000pepe tokenomics. The total 1000pepe supply and its 1000pepe distribution create the playing field that either encourages healthy growth or enables manipulation. I’ve tracked whale wallets across dozens of projects, and the patterns are surprisingly predictable once you understand the rules of the game. This guide will demystify both the players and the playing field, giving you the insight to anticipate major moves.

Understanding 1000pepe Tokenomics: The Rulebook

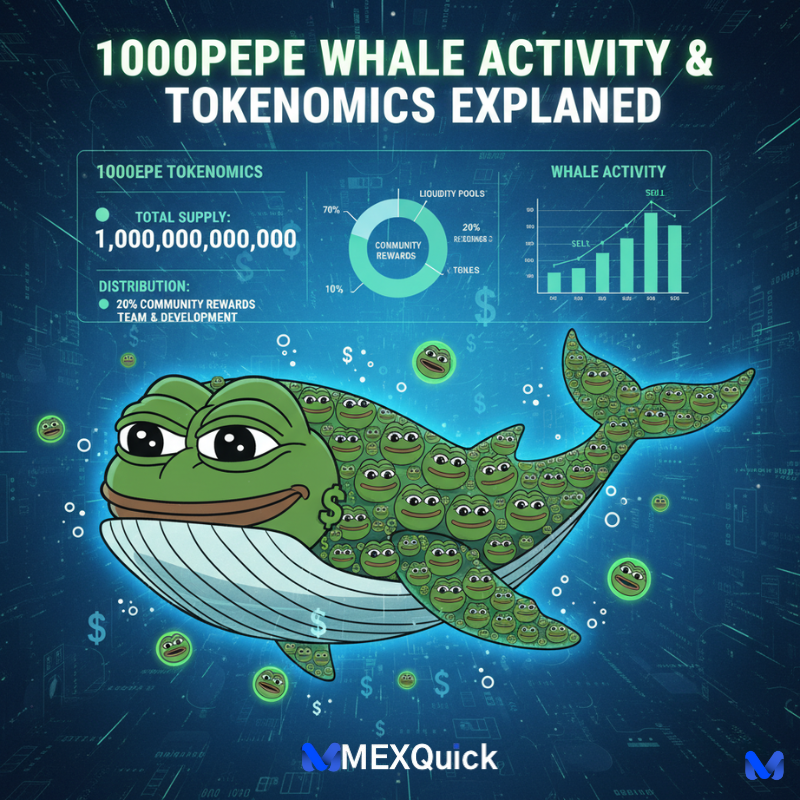

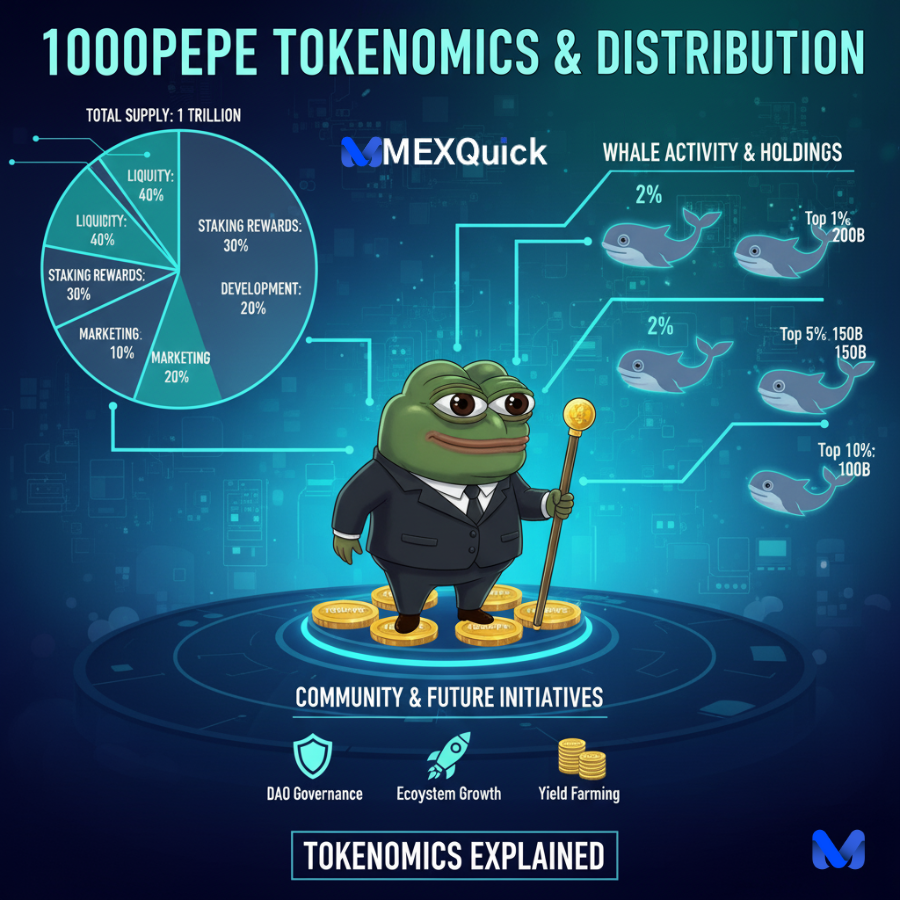

Before we analyze the whales, we need to understand the economic structure they’re operating within. 1000pepe tokenomics refers to the economic policies that govern the token.

Breaking Down the 1000pepe Supply

Not all supplies are created equal. You need to look at two key figures:

-

Total Supply: The complete number of tokens that currently exist, including those in circulation and those locked or reserved.

-

Circulating Supply: The number of tokens actually available to the public and actively trading on the market.

-

Why It Matters: A large difference between total and circulating supply can signal future sell pressure. If a huge portion of the total 1000pepe supply is locked and scheduled to be released later, it could dilute the value for current holders when it unlocks.

Analyzing the 1000pepe Distribution

This is arguably the most critical part of tokenomics. It answers the question: “How were the tokens initially spread out?”

-

Fair Launch vs. Pre-sale: Was the token launched fairly, with everyone having an equal opportunity to buy in? Or was a large percentage sold to early investors at a steep discount? A pre-sale often creates instant whales who may dump their tokens for a quick profit.

-

Team and Treasury Allocations: Does the project’s team hold a significant percentage? While some is necessary for development, a large, unvested team allocation can be a red flag for future sell-offs.

Tracking 1000pepe Whales: The Major Players

1000pepe whales are typically defined as wallets holding a percentage of the total supply large enough to significantly impact the price if they sell. Let’s explore how to spot them and interpret their moves.

How to Identify and Track Whale Wallets

You don’t need expensive tools to start whale-watching.

-

Use Blockchain Explorers: Platforms like Etherscan (for Ethereum-based tokens) allow you to view the top holders list. This shows you the wallets with the largest balances.

-

Set Up Alerts: Services like DexScreener and DexTools allow you to set up alerts for large transactions (e.g., “alert me for any sell over $50,000”). This gives you real-time intelligence on whale movement.

-

Watch for Wallet Clustering: Sometimes, a single entity controls multiple wallets. If several wallets make identical trades at the same time, you’re likely seeing a single whale’s strategy unfold.

Interpreting Common Whale Behaviors

Whale activity isn’t inherently good or bad; it’s the context that matters.

-

Accumulation: When whales are consistently buying large amounts off-exchange or in small chunks on the market, it’s a strong bullish signal. They are building a position without moving the price up, often before positive news.

-

Distribution: The opposite of accumulation. Whales sell their holdings into market strength. This can cap upward price movement and often precedes a downturn.

-

Wallet Splitting: A whale moving funds from one large wallet into dozens of smaller ones. This can be a preparation for a large sell-off, allowing them to avoid triggering panic with a single massive transaction.

How Tokenomics and Whales Interact: A Case Study

The 1000pepe distribution model directly influences how much power whales have. Let’s look at a hypothetical scenario:

-

Scenario A (Concentrated Distribution): 60% of the 1000pepe supply is held by just 10 wallets. In this case, the project is extremely vulnerable. These 1000pepe whales can collude to pump the price and then dump their bags on retail investors. The tokenomics create a high-risk environment.

-

Scenario B (Wide Distribution): The top 100 wallets hold only 20% of the supply, with the rest spread among thousands of small holders. This is a much healthier structure. While whales still exist, their ability to manipulate the market is limited. The price is driven more by organic supply and demand.

The Lesson: Always cross-reference whale activity with the tokenomics. A whale buying in a project with a concentrated supply is riskier than a whale buying in a project with a wide, fair distribution.

Actionable Tips for Navigating a Whale-Heavy Market

You can’t stop the whales, but you can learn to sail the waves they create.

-

Follow the Smart Money: If you see a known, reputable investor or fund accumulating a token, it’s worth investigating their thesis. However, always do your own research.

-

Beware of Artificial Pumps: A rapid price pump on low volume can be a whale artificially inflating the price to attract buyers before they sell. Check if the price increase is supported by high trading volume.

-

Use Whale Watching as a Confirmation Tool: Don’t base your entire strategy on whale moves. Use it as one data point alongside technical analysis, project development, and market sentiment.

Conclusion: Knowledge is Your Defense Against Volatility

Understanding 1000pepe whales and the underlying 1000pepe tokenomics transforms you from a passive observer into an informed participant. You’re no longer left wondering why the price is moving; you can see the mechanics behind the curtain. A project’s 1000pepe distribution and supply model set the stage, and the whales are the lead actors. Your goal is to understand the script.

By monitoring these factors, you can better manage your risk, identify potential opportunities early, and avoid being caught on the wrong side of a whale’s trade.

Your Action Plan:

-

Bookmark the Etherscan page for 1000pepe and check the “Holders” tab weekly.

-

Identify the top 10 wallets and make a note of their balances. Watch for significant changes.

-

Review the project’s tokenomics documentation to understand the total supply, vesting schedules, and initial distribution.

Have you spotted any interesting whale activity recently? What’s your take on 1000pepe’s tokenomics? Share your findings in the comments below—let’s pool our observations. If this guide helped you see the market in a new light, please share it with other investors.