Ever felt like binary options traders are speaking a different language? You’re not alone.

When I first started, terms like “OTM,” “expiry,” and “strike price” flew over my head. I made a few trades based on gut feeling alone and, frankly, I lost money. It wasn’t until I took the time to truly understand the binary options terminology that everything clicked. My decisions became smarter, my strategy clearer, and my results improved dramatically.

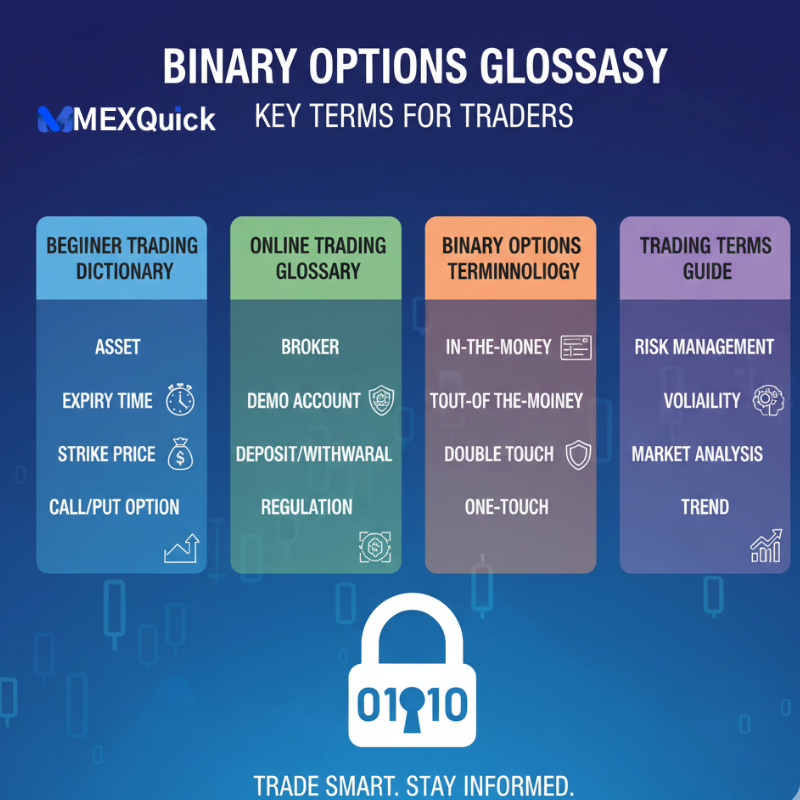

That’s why I’ve created this ultimate binary options glossary. Think of this as your personal beginner trading dictionary—a cheat sheet to decode the market’s language and build a solid foundation for your trading journey. Let’s dive in.

Why a Glossary is Your Secret Weapon for Binary Options Trading

You wouldn’t play a complex board game without reading the rules first, right? Trading is the same. Understanding the key binary options words is not just academic; it’s practical and essential for your success.

Here’s why:

- Prevents Costly Mistakes: Misunderstanding a term can lead to a wrong trade.

- Builds Confidence: Knowing the language allows you to navigate platforms and analyze markets with assurance.

- Enables Learning: All advanced strategies and educational materials use this terminology. You can’t learn them if you don’t speak the language.

Consider this trading terms guide your first and most important investment.

Key Binary Options Terms and Definitions: The A-Z(ish) Guide

Let’s break down the essential vocabulary you’ll encounter every day.

Common Trading Terms Every Beginner Must Know

These are the absolute basics. Master these, and you’re 80% of the way there.

- Binary Options: A type of financial option where the payoff is either a fixed amount of compensation or nothing at all. The outcome is binary—hence the name—meaning either you win or you lose.

- Call/Put: The two fundamental trade types.

- Call Option: A bet that the price of an asset will rise before the option expires.

- Put Option: A bet that the price of an asset will fall before the option expires.

- Underlying Asset: The financial instrument on which your binary option is based. This is what you’re making a prediction on. Common examples include:

- Currency Pairs (Forex): EUR/USD, GBP/JPY

- Stocks (Indices): S&P 500, FTSE 100

- Commodities: Gold, Oil, Silver

- Cryptocurrencies: Bitcoin, Ethereum

- Strike Price: The predetermined price level of the underlying asset that your option is targeting. Your prediction is whether the asset’s price will be above or below this strike price at expiry.

- Expiry Time (or Expiration): The exact future date and time when your binary option contract ends and is settled. This can be as short as 60 seconds or as long as several months.

- Payout: The fixed percentage return you receive from your broker if your trade is correct. For example, if you invest $100 on an option with an 80% payout, you will receive $180 back ($100 initial investment + $80 profit).

- In-the-Money (ITM): This means your trade was successful. Your prediction was correct at the time of expiry, and you receive the agreed payout.

- A Call option is ITM if the asset price is above the strike price at expiry.

- A Put option is ITM if the asset price is below the strike price at expiry.

- Out-of-the-Money (OTM): This means your trade was unsuccessful. Your prediction was wrong at the time of expiry, and you lose your initial investment.

- A Call option is OTM if the asset price is below the strike price at expiry.

- A Put option is OTM if the asset price is above the strike price at expiry.

Level Up: Advanced Terms for Growing Traders

As you progress, you’ll hear these terms. They help describe more complex strategies and market conditions.

- At-the-Money (ATM): When the underlying asset’s price is exactly at the strike price. Different brokers have different rules for settling ATM trades, so always check their policy.

- Broker: The company that provides you with the trading platform to buy and sell binary options. Choosing a reputable and regulated broker is critical.

- Return-to-Investor (RTI): This is just another term for Payout. It’s the percentage of your investment returned to you on a winning trade.

- Market Analysis: The process of evaluating and predicting market movements. The two main types are:

- Technical Analysis: Analyzing historical price charts and using indicators (like moving averages or RSI) to predict future price movement.

- Fundamental Analysis: Analyzing economic news, reports, and global events (like interest rate decisions or GDP data) that influence asset prices.

- Risk Management: The strategies you use to protect your capital. The most important rule in binary options is to never risk more than you can afford to lose on a single trade.

How to Use This Online Trading Glossary Effectively

Don’t just read this once and forget about it. Here’s my actionable advice:

- Bookmark This Page: Seriously, do it now. Keep this online trading glossary open in a browser tab while you’re analyzing the markets or placing trades.

- Learn 3 Terms a Day: If it feels overwhelming, focus on digesting just a few terms each day. Try to find examples of them on your broker’s demo platform.

- Practice on a Demo Account: The best way to learn is by doing. Use a demo account to place trades where your only goal is to understand how these terms work in real time, without risking real money.

Examples of Binary Options Trades Using Key Terms

Let’s make ita all concrete with a simple scenario.

Situation: Apple Inc. (AAPL) stock is currently trading at $170. You believe a new product announcement will cause the price to rise in the next hour.

- Your Action: You decide to buy a Call option.

- Underlying Asset: Apple Stock (AAPL)

- Strike Price: $170

- Expiry Time: 1 hour from now

- Investment: $50

- Payout: 85%

Possible Outcomes at Expiry:

- ITM (In-the-Money): AAPL is trading at $172. Your prediction was correct! You win the trade. Your return is $50 + ($50 * 0.85) = $92.50.

- OTM (Out-of-the-Money): AAPL is trading at $169. Your prediction was wrong. You lose your initial investment of $50.

Your Jargon-Busting Cheat Sheet: Summary of Key Terms

| Term | Definition | Why It Matters |

| Call/Put | A bet that the price will go UP (Call) or DOWN (Put). | The two fundamental actions you take. |

| Underlying Asset | The stock, currency pair, or commodity you’re trading. | The focus of your analysis and prediction. |

| Strike Price | The target price you’re predicting the asset will be above or below. | The specific level that determines your win or loss. |

| Expiry Time | The exact moment the trade closes and is settled. | Defines the timeframe of your prediction. |

| Payout/RTI | The fixed profit percentage you earn on a winning trade. | tells you your potential reward before you invest. |

| ITM/OTM | “In-the-Money” (win) or “Out-of-the-Money” (loss). | The final result of your trade. |

Conclusion: Trade with Confidence by Mastering the Language

Knowing these key binary options words transforms you from a gambler into a strategic trader. This binary options glossary is more than just a list of definitions—it’s a toolkit for making informed, confident decisions.

Print it out, save it, and refer to it often. The path to becoming a successful trader is paved with knowledge, and it all starts with understanding the language of the markets.

Now I’d love to hear from you: Which of these terms did you find most confusing before reading this guide? Let me know in the comments below, and I’ll be happy to clarify!